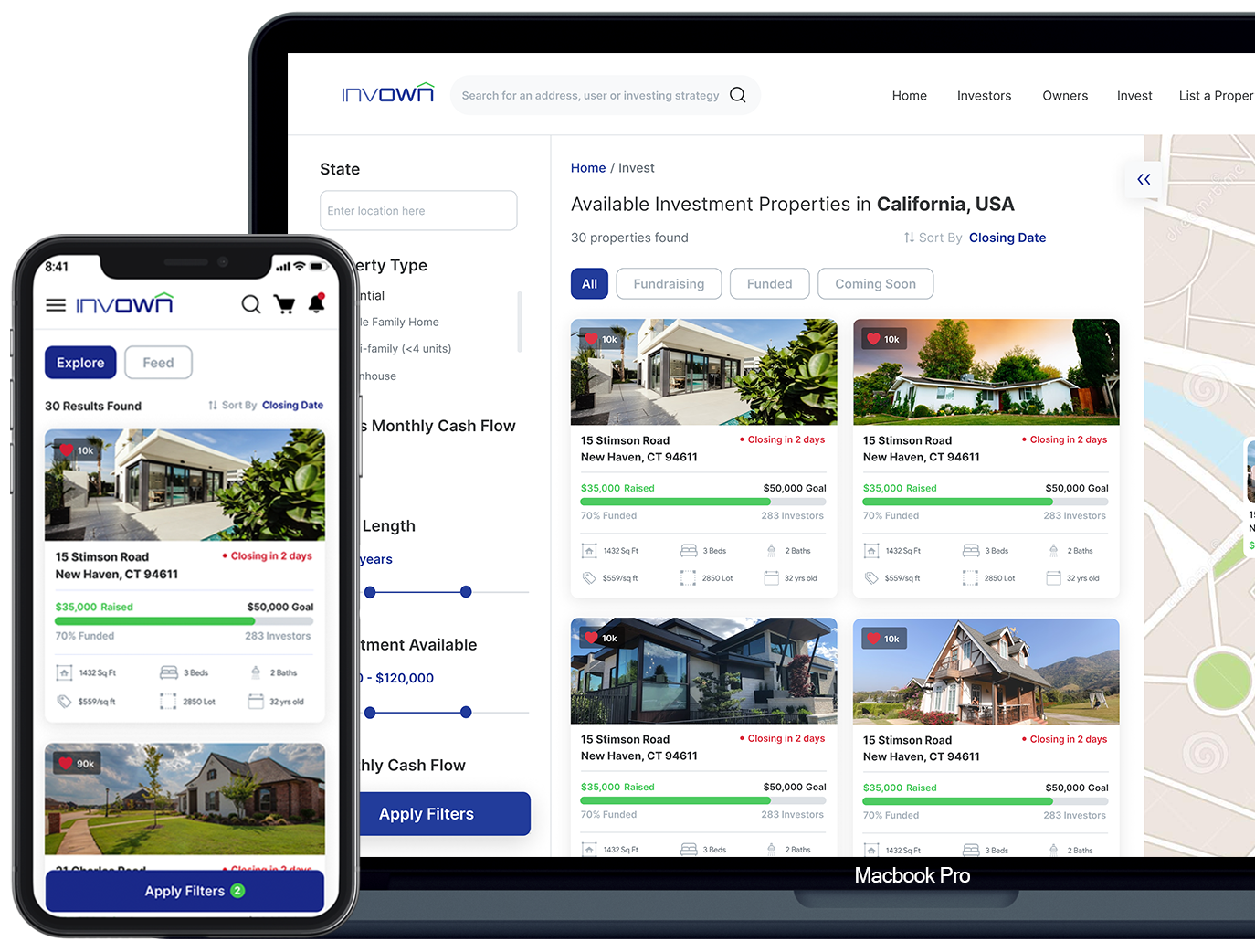

Invown for Investors

Invest in real estate companies and avoid the headache of owning property. What’s the best part? Invown brings the investments to you!

Diversify your portfolio

Build a diverse and tailored investment portfolio by investing in real estate companies with as little as $1,000.

No Property Maintenance

Investors aren’t responsible for maintenance, property management, or tenants because they don’t own the property.

National Presence

Invown offers investment opportunities in companies that own property from locations within the United States.

Exposure to Real Estate Markets

Build a diverse and tailored investment portfolio with exposure to residential and commercial real estate values.

What am I investing in?

When you invest through Invown, you’re investing in a real estate company that offers you a percentage of equity in their company.

The Benefits

Realize the gains that real estate companies earn by owning property across the country, including all the potential upside (or risk), without the responsibility of ownership.

The Risks

Investments offered on Invown are illiquid and, like all privately bought securities, contain inherent risk. Investors in this type of security can lose the entire value of their investment. In addition, investments on Invown are highly speculative. Never invest more than you can afford.

Return on Investment

Any return on investment numbers on Invown are projections by the issuer based on certain assumptions and Invown cannot and does not predict any potential return. You need to review each offering to decide if the potential risk/reward is worth the investment.

How does it work?

Invown matches investors wanting equity with real estate companies seeking financing

Have a question?

Invown can answer all of your questions to help you with your investment process.

hello@35.225.152.202

203-889-5384